does maine tax retirement pensions

On the other hand if you. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs.

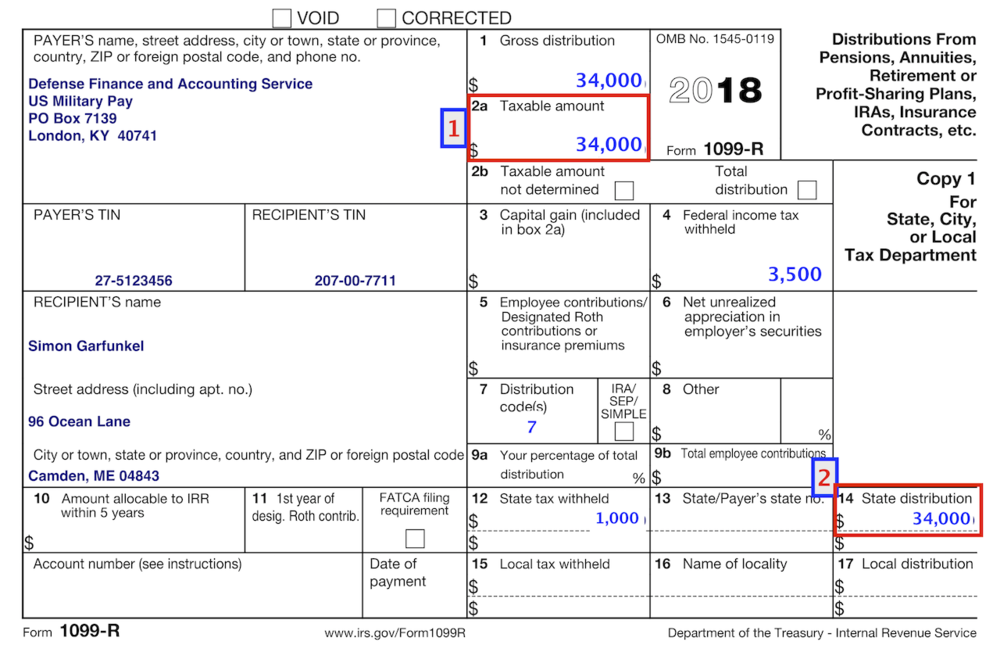

A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. Employer Self Service login. Subtract the amount in Box 14 from.

Maine Income Tax on Military Disability Retirement Pay. June 6 2019 239 am. However that deduction is reduced in an amount equal to your annual Social.

For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov. See below Pick-up Contributions. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

The 10000 must be reduced by all taxable and nontaxable social. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. The Pension Income Deduction.

One of the biggest factors that will determine your tax bill in retirement is where you live and. In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including. Over 65 retirement income exclusion up.

Call us toll free. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting. 52 rows Exclusion reduced to 31110 for pension and annuity.

The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. Taxes on Pension Income. To All MainePERS Retirees.

You will have to. Does Maine Tax Retirement Pensions. If you believe that your refund may be.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. June 6 2019 239 am. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income.

Military Disability Retirement Pay received as a pension annuity or similar. Military retirement pay is exempt from taxes beginning Jan. June 6 2019 239 AM.

Maine allows for a deduction of up to 10000 per year on pension income. Learn more about Maine Income Taxes on Military Pay.

Does Maine Tax Social Security

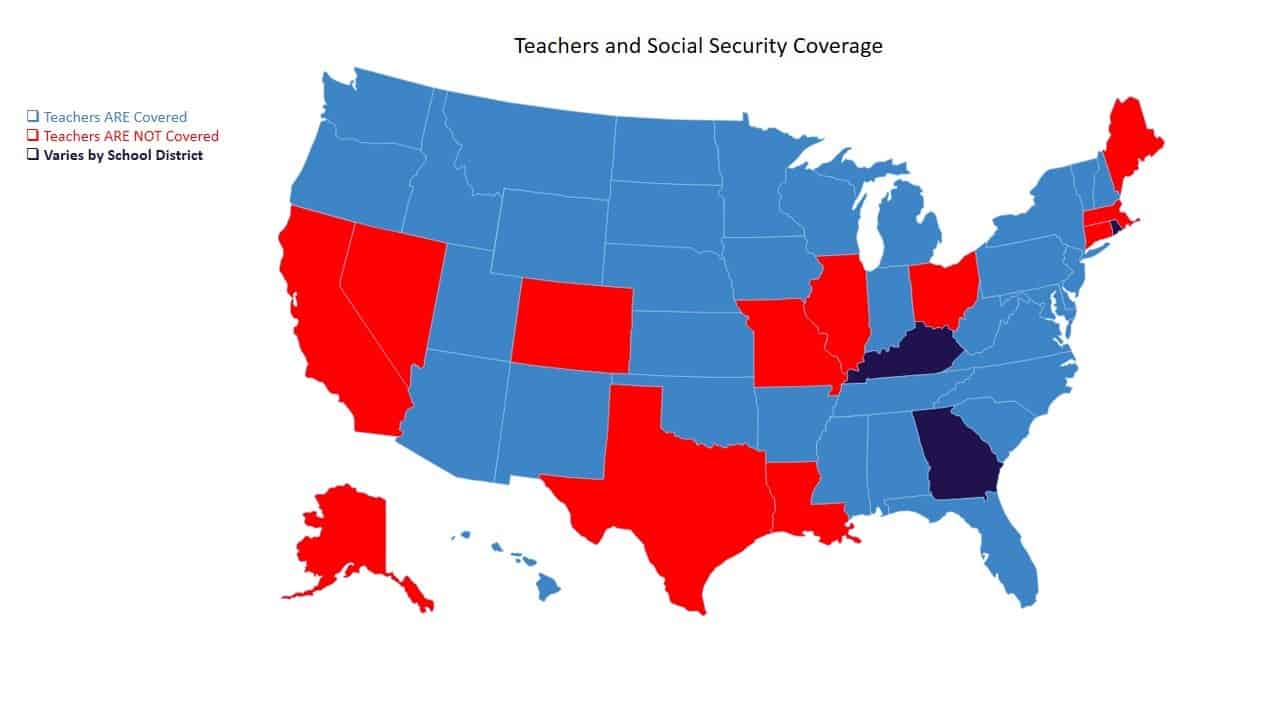

Windfall Provision Iis Financial Services Financial Advisor In Augusta Maine

Maine Eyes Repealing Income Tax On Public Employees Pensions

Military Retirement And State Income Tax Military Com

403b Tsa Annuity For Public Employees National Educational Services

10 Most Tax Friendly States For Retirees Kiplinger

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

Retiring These States Won T Tax Your Distributions

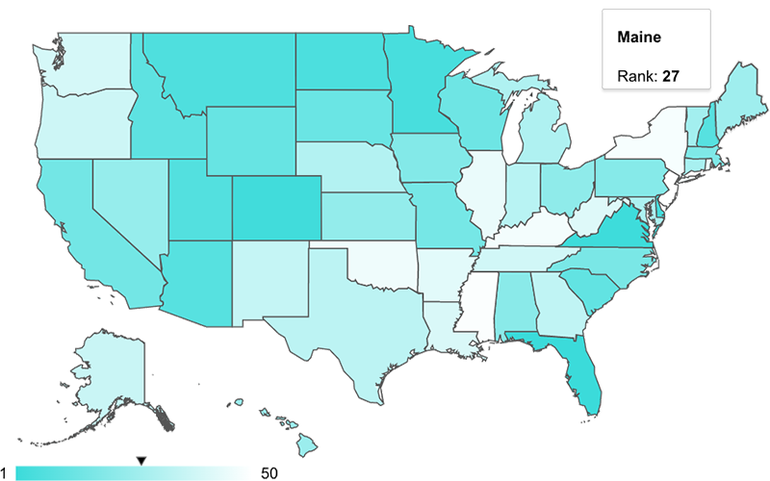

Best Worst States To Retire In 2022 Guide

Maine Among Priciest States To Retire Study Says Mainebiz Biz

Maine Retirement Taxes And Economic Factors To Consider

Teacher S Retirement And Social Security Social Security Intelligence

Maine State Tax Guide Kiplinger

Learn About Retirement Income And Annuity Tax H R Block

Maine Relief Checks 2022 Ca H Maine

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer